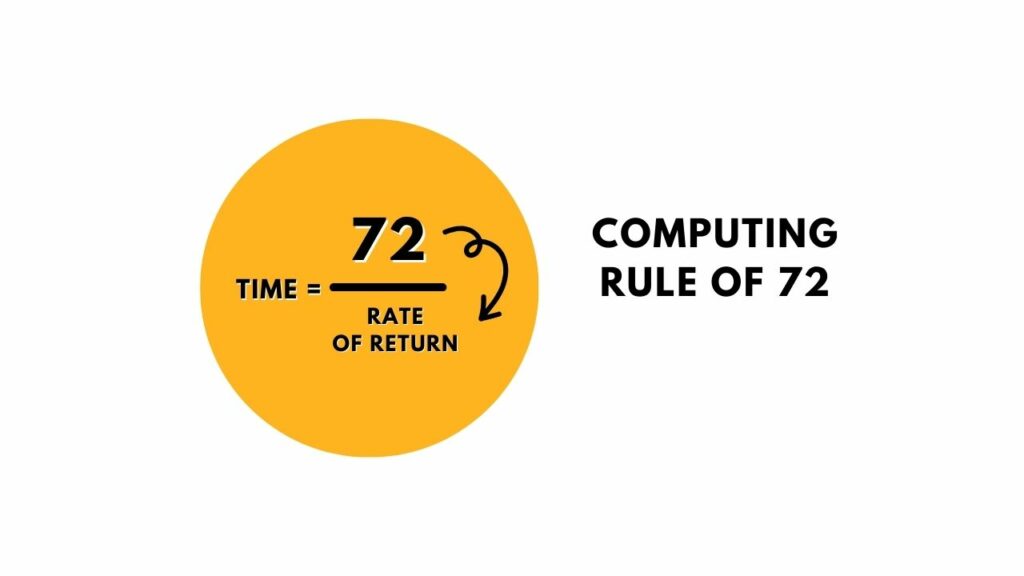

The Rule of 72 is a quick and easy way to estimate how long it will take for your savings to double. While the formula is simple, it can give you a rough idea of how quickly your investment will grow over time based on the average annual rate of return or inflation rate. For example, if you’re saving money in an account that earns 2% interest per year and you want to know how long it will take for your balance to double from $10,000 to $20,000, simply divide 72 by 2% (0.02) and get 36 years—that’s about three decades!

The Rule of 72 is a simple mathematical formula that can be used to determine how long it will take for an investment to double.

The Rule of 72 is a simple mathematical formula that can be used to determine how long it will take for an investment to double. The rule states that if you divide the total amount of time it takes for your initial investment to double by 72, then you will get the approximate number of years it will take for your savings to double in value. This rule represents the doubling power of compound interest and assumes that earnings are reinvested back into the same asset so as not to dilute their effect on ultimate growth.

For example, if you invest $100 at 10% interest per year and want to know how long it would take before your money doubles in value (you can also say: “how long until my $100 increases in value by 100%?”), then divide 2 by 7 (or 1/7). This equals roughly 28 years—which means your initial investment would require 28 years at 10% interest before doubling its worth!

The Rule of 72 can be used to calculate the number of years it will take any given amount of money to double.

The Rule of 72 calculates the number of years it will take an investment to double at a given rate of return. This rule is an approximation and works best within the range where you can expect your investments to grow at around 6-7% annually.

That said, it’s still a handy little tool for ballparking how long it’ll take for your money to double. For example, if your investments are growing at 7% per year (a pretty common expectation), then 72 divided by 7 equals 10 years. That means that any amount you invest today should approximately double in 10 years’ time—assuming no change in interest rates or inflation levels over that period.

If you put $1 into an account earning 7%, you’ll have $2 after 10 years: $1 times 1 + ($1 x 1) = 2 x 1 = 2

The Rule of 72 also makes sense because it’s roughly equal to how many times income must increase each year for people on average incomes to experience real income growth (i.e., when inflation isn’t factored in). For example: If someone earns $50K per year now but their paycheck rises 4% every year until retirement age when they earn $100K annually (due mostly due inflation), they’ve actually experienced zero real income growth during those 30 years!

If a security or investment is expected to earn an average annual rate of return “r” over a specific period, then you can use an approximation for the number of years required for that investment to double by dividing 72 by “r.”

The Rule of 72 is a formula for approximating the number of years it takes for an investment to double in value. The rule states that if a security or investment is expected to earn an average annual rate of return “r” over a specific period, then you can use an approximation for the number of years required for that investment to double by dividing 72 by “r.”

In other words, if you have an investment that earns 8% annually, it will take approximately 9 years (72/8) for your initial $100 to become $200. If you earn 10% each year on your money, then it will take 7.2 years (72/10).

An alternative calculation uses 70 instead of 72, but the results are very similar.

To calculate the number of years it will take a given amount of money to double using this method, divide the annual rate of return by 70. For example, if you had $100,000 and expected an 8% annual return on your investment over the next decade, it would take about 12 years for that money to double in value.

Conversely, you can calculate how long a certain interest rate will be needed to double an initial sum at any given time period by dividing 100 by the interest rate and multiplying that number by 72.

For example: If someone had $1 million dollars and wanted to know how many years it would take their savings account with an average annual interest rate of 6% (6%) to double their money (or increase its value by 100%). They would first divide 6 into 1 million dollars: 1 million divided into 6 is 167 thousand ($1 million/$6 = 167k). Next, they would multiply that answer by 72 because there are 72 weeks in one year: $167k times 72 = 12 million dollars worth of interest earned over a ten-year period at an average yearly earnings growth rate of 6%.

The Rule of 72 can help investors roughly estimate how long it will take their savings to double in value.

The Rule of 72 is a quick and easy way to estimate how long it will take an investment to double in value. In fact, the rule of 72 can be used to help investors roughly estimate how long it will take their savings to double in value.

The Rule of 72 is based on the idea that if you divide a number by the interest rate for that investment, you can determine how long it would take for your initial investment to double at that same interest rate. For example: If your savings are earning 8 percent per year, then divide 72 by 8 tells us that your savings will double in 7 years (72 divided by 8 = 7).

Conclusion

The Rule of 72 is a simple and effective way to estimate how long it will take for an investment or savings account to double in value. While this formula does have its limitations, it is still a valuable tool for anyone looking to calculate how long it will take their money to grow. The Rule of 72 can also be used as an approximation for other financial calculations such as determining the annual interest rate earned on an annuity (or similar investments) given its face value, time period and current market conditions.