Planning for a cost-effective future starts now. With a plethora of options available, finding the best budget planner can be a daunting task.

Irrespective of your status as a seasoned financial planner, a beginner just starting, or even a traveling professional, there’s a planner designed to cater to your needs. This literary expedition dives into the world of these budgeting tools, aiming to offer insights that will guide you in choosing the optimal budget planner for this year.

Best Budgeting Planners

Comparison between Clever Fox Budget Planner and GoGirl Budget Planner

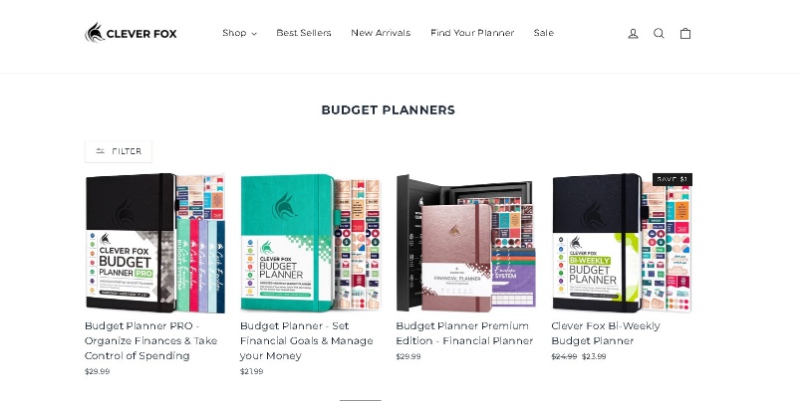

Regarding best-reviewed budget planners, Clever Fox Budget Planner and GoGirl Budget Planner offer unparalleled features. The Clever Fox Budget Planner Pro includes monthly budget pages and a calendar, making planning and tracking your spending easy.

It also provides an affordable choice for those needing a detailed budget. The GoGirl Budget Planner is a top choice for women thanks to its compact size and beautiful aesthetic.

Clever Fox Budget Planner is non-gender specific and has a simplistic, uncluttered design making it appealing to a vast audience. It comes with a money-back guarantee, thus reassuring users of its quality. It efficiently helps you to track and organize your bills, incomes, expenses, savings, debts, and budgeting goals all in one place.

GoGirl Planner, however, is primarily marketed towards women and capitalize on style with available choices of vibrant cover colors, stickers, and a portable, compact size optimal for travel and daily use. It covers weekly, monthly, and yearly budgeting while keeping an eye on savings and expenses. The efficiency of the GoGirl planner can also be seen in the additional features, like a pocket for small bills, a pen holder, an elastic band, etc.

In terms of cost, both budget planners sit in a similar price range, making them affordable and competitive within the market. One of the major differences lies in their aesthetic and target audience: Clever Fox strives for simplicity and wide applicability; while GoGirl aims to provide a stylish, female-focused budget planner.

Both planners provide instructional pages at the start to guide users on how to effectively use the planner, encouraging and teaching financial discipline no matter what your financial goals may be.

So, the choice between the two depends entirely on personal preferences. Whether it’s the gender-neutral and straightforward design of the Clever Fox Budget Planner you prefer, or the vibrant, female-focused design of the GoGirl Budget Planner, both planners offer a comprehensive and systematic way to manage finances.

Review of the Best Budget Planner Books

Best budget planner books vary based on your specific needs. Names like Erin Condren’s and the Limitless Mindset Budget Planner are heavily recommended, known for their detailed budget sheets, comprehensive financial layouts, and user-friendly designs. These budget planner books can enhance your experience and help you master your financial planning.

1. Erin Condren Budget Book

Well-known in the budgeting world, Erin Condren’s Budget Book stands out due to its highly detailed yet easy-to-use financial planning pages.

It includes monthly expense trackers, savings trackers, and debt payment logs. Further, its delightful design makes financial planning a pleasant experience instead of a chore. This budget book is also compatible with the Erin Condren Coiled LifePlanner.

2. The Limitless Mindset Budget Planner

This is a masterpiece for those looking to have control over their financial life. The planner includes weekly and monthly spending summaries and future financial planning sections such as savings and investment spaces.

This budget planner also includes an annual financial review, enabling users to gauge financial health and growth. It’s user-friendly, making it a top choice for beginners trying to understand their financial situation.

See Related: Favorite Money Saving Memories

3. Clever Fox Budget Planner

Another excellent budget book on the market, Clever Fox Budget Planner, allows you to track your income, savings, expenses, debts, and bills. The planner is designed with motivational quotes to keep you inspired on your financial journey. It’s comprehensive, easy-to-use, and comes in various colors, making budgeting visually appealing.

4. GoGirl Budget Planner

This well-organized budget planner is a hit, especially among women. Besides regular financial tracking elements, it contains gratitude and affirmation pages, keeping you mentally healthy too. The compact size makes it portable, convenient to carry around and keep track of your finances anywhere.

5. MoKo Budget Planner Organizer

This organizer is known for its durability because of its hardcover design and the band it comes with, that keeps it securely closed. It comes with twelve colorful budget envelopes with budget and expense sheets, making it simpler to manage your cash budget.

Each of these budget planners offers a different set of features to help improve financial planning. Choose one that best suits your financial needs and personal preferences. Remember, the best budget planner is the one that you’ll use consistently and enjoy to use.

What Makes a Budget Planner the “Best”

The best budget planners are not only affordable and reliable, but they also offer features that are tailored to the user’s specific needs and preferences. From monthly spending reviews, detailed budget pages, planning spaces for monthly goals, and comprehensive monthly income reporting, the best budget planners to help manage financials are adaptable and responsive to your unique situation.

- Customization: This is probably the most crucial aspect of a budget planner. Users have different needs and financial goals, so the planner should be customizable to cater to individual requirements. It should allow you to categorize your expenses, track your income, and allocate funds to specific financial goals.

- Easy-to-use: Regardless of its advanced features, a budget planner should be user-friendly. It should not complicate your budgeting process, but rather simplify it. This means it should have an understandable layout, clear instructions, and easy navigation.

- Comprehensive tracking: The planner should have functionality to record every single penny that comes in and goes out. This includes all forms of income and expenses, whether fixed or variable.

- Goal-setting feature: The best planners will include a section for you to set your financial goals. Whether you want to save for a vacation, pay off debt, or invest, the planner should allow you to track your progress towards these goals.

- Review and analysis: It’s not enough to just record your income and expenses. The planner should also provide a way for you to analyze this information. This could be through summaries, graphs, or charts that give you a clear picture of your financial health.

- Dedication to saving: A good budget planner should help you prioritize saving. It should encourage you to allocate a certain portion of your income towards savings, and help you stick to this every month.

- Consistency: Finally, the best planner should inspire you to be consistent. Budgeting is a habit that requires regular effort, and the planner should make this process easier for you.

Ultimately, the best budget planner is the one that best helps you manage your finances and achieve your short and long-term financial goals. Keep these features in mind when choosing a budget planner to ensure that it fits your specific needs and preferences.

How to Use a Budget Planner

Benefits of Using a Monthly Budget Planner

A monthly budget planner tracks income and expenses, lets you set financial goals, and regularly reviews your progress. By having a clear picture of your monthly payment and spending, you can make informed financial decisions and achieve your goals in a more organized manner.

- Avoid Overspending: When you have a clear outlook on your monthly income and expenses, it’s easier to control your spending and avoid going beyond your budget. This helps avoid unnecessary debt and keeps your finances in check.

- Saving: By managing your income and expenses efficiently, you can enhance your capacity to save. A budget planner enables you to set aside a certain amount of money every month, be it for short-term or long-term goals.

- Debt Management: A powerful management tool, a budget planner can aid in debt management. If you have outstanding debts, you can plan your monthly payments strategically and gradually pay off your debt.

- Financial Independence: A budget planner brings discipline in your financial life. It makes you accountable for your spending, helping to build a consistent habit of saving and smart spending, which eventually leads to financial independence.

- Emergency Fund: If planned properly, a portion of your income can be set aside as an emergency fund every month. This can help during unforeseen circumstances like medical emergencies, job loss, etc.

- Investment Planning: Through a monthly budget planner, you can identify your savings and use them in various investment avenues for future returns.

- Goal Achievement: By allocating money for specific purposes, you are likely to achieve your financial goals faster. Be it buying a house, a car or saving for your child’s education, a budget planner can make it happen.

- Reduced Financial Stress: Having control over your finances and knowing where your money is going creates a sense of calm and reduces financial stress.

- Identifying bad spending habits: By laying out all your income and expenses, you can easily identify bad spending habits and take necessary actions to correct them.

- Financial Security: In the long run, the habit of monthly budgeting contributes to financial security. You become more aware of your spending habits and start making smarter financial decisions.

See Related: Reasons to Avoid High Expense Ratio Index Funds

Step-by-Step Guide to Using a Budget Planner Book

Using a budget planner book involves consistently tracking income, expenses, and financial goals. Begin by noting down your payment, then allocate amounts for monthly bills and savings. Track your spending and adjust accordingly. Regularly review and update to ensure you’re on track.

- Purchase a Budget Planner Book: You can easily find a budget planner book online or at a store. It is advisable to buy a binder-style planner as it is more flexible and you can add or remove pages as per your preferences. Choose one with sufficient space for monthly entries and other components such as financial goals, savings, debt tracking, etc.

- Understand Your Income: The first step to using your budget planner book is to figure out your monthly income. This should not only include your regular paycheck but also other income sources like side jobs, investments, etc. Write down your total monthly income on the income page.

- List All Your Expenses: On the expenses page, list all your fixed expenses first. This can include rent, utilities, insurances, groceries, etc. Also, include variable costs such as dining out, shopping, transportation, etc.

- Allocate Funds for Each Expense: On the next stage, determine how much money you plan to spend on each expense. Make sure that the total does not exceed your income. It’s a good idea to leave some wiggle room for unexpected costs or opportunities.

- Set Financial Goals: Write down your short-term and long-term financial goals. These can be saving for a vacation, buying a house, starting a business, or retiring early.

- Keep Track of Your Expenditures: Use your budget planner book to record every expenditure, regardless of how small. Collect all receipts and bills and update the book at least once a week to avoid oversights.

- Evaluate and Adjust Your Budget: At the end of the month, analyze where your money went. Assess if you can reduce spending in certain areas and if you are on track to meet your financial goals.

- Update Your Planner: Regularly updating and reviewing your budget planner will ensure that you stay on track. It can also help identify patterns in your spending and find ways to improve your financial habits.

- Future Planning: Base your future plans on your past spending habits. You can more accurately predict budgets for the upcoming months when you know where your money has been going.

- Motivate Yourself: It can be a challenge to stick to a budget, but keep reminding yourself of your goals. You can also set rewards for yourself when you achieve a milestone to keep motivated.

Remember, a budget planner book is just a tool. It’s up to you to use it effectively and consistently to manage your personal finances.

Tips for Maximum Efficiency in Budget Planning

Ensure you are honest about your income and spending habits. Always remember to factor in unexpected expenses and to review your planner regularly. Utilizing these tips alongside the best budgeting tools can maximize your budget planning efficiency.

- Identify your Financial Goals: Take time to identify and set long-term and short-term financial goals. This will guide you in allocating and prioritizing your resources effectively.

- Track Your Income and Expenses: Keep a record of all your income sources, expenditures, and transactions. Tracking your expenditures will help you identify areas where you are overspending and where cuts can be made.

- Prioritize your Spending: Not all expenses are of equal importance. Identify and prioritize your spending according to necessity. There should be clear distinction between wants and needs.

- Set a Realistic Budget: Set a budget that aligns with your income and expenses. Make sure your budget is realistic, achievable, and flexible enough to allow for changes in income and expenses.

- Utilize Budgeting Tools: Take advantage of budgeting tools and apps. These tools provide insights, reminders, and analytics that can help you keep track of your financial performance and stay on track.

- Save for Unexpected Expenses: Allocate for emergencies or unexpected expenditures. This will provide a buffer against unforeseen financial circumstances.

- Regularly Review and Adjust Your Budget: Your budget is not set in stone. As your finances, lifestyle, and priorities change, your budget should adapt and evolve to match these changes.

- Reduce Debt: Budget for debt repayment: High interest debts should be paid off as quickly as possible to avoid paying more in the long run.

- Automate Savings: Consider setting up an automatic transfer to move money from your checking account to your savings account. This ensures you are consistently saving money.

- Educate Yourself: Increase your financial literacy knowledge. Understanding financial basics will give you the confidence and skill to make better financial decisions.

Remember, budgeting is a continuous process, not a one-time event. It is vital to regularly review and adjust your budget to stay on course. Remember, the goal of budgeting is to help you gain control of your finances and achieve your financial goals.

By utilizing these tips, you can maximize your budget planning efficiency.

The Best Online and App Budget Planners

Top Budgeting Apps for 2021/2022

Budgeting apps such as Mint, PocketGuard, and YNAB are among the top budgeting tools for 2021 and 2022. These apps provide a digital way to maintain and monitor budgets, making it easier to manage finances.

Benefits and Drawbacks of Digital Budgeting

Digital budgeting provides convenience and simplicity, with real-time updates and tracking available at your fingertips. But, they may lack the detailed manual tracking system physical budget planners offer and require reliable internet to function optimally.

Free Online Budgeting Planners

For those looking for a cost-effective tool, free online budgeting planners such as Personal Capital and EveryDollar offer a great way to see an overview of your spending and make adjustments as needed.

Paid Budgeting Apps

Paid budgeting apps such as YNAB, Simplifi by Quicken, and Tiller provide additional features, like personalized budgeting tips, cash flow insights, and automated spreadsheet updates. However, these apps require a monthly or annual fee.

User-friendly Budgeting Apps for Beginners

For those new to budgeting, Mint, Wally, and PocketGuard offer user-friendly interfaces. These apps simplify the process through easy-to-understand graphs and charts representing your financial health.

Comprehensive Planning Budgeting Apps

For those looking for in-depth financial and investment planning, Personal Capital and Wealthfront might be the best choices. They can synthesize various financial elements like retirement and investment planning, along with regular budgeting.

Choosing the best budgeting app boils down to personal preferences and needs. Some may prefer the interaction of manual tracking, while others enjoy the convenience of digital budgeting. No matter what you choose, budgeting tools can provide valuable assistance in managing your finances.

See Related: Starting a Financial Independence Blog

Budgeting Planners for Beginners

Choosing the Right Budget Notebook for Beginners

You may prefer a budget notebook with clear and concise categories for tracking your income and expenses when starting your budgeting journey. The Boxclever Press Budget Planner is one of the best budget planners for 2023, ideal for beginners, thanks to its straightforward design and user-friendly interface.

This A5 size planner comes with a faux leather cover and a sturdy elastic band to keep it closed securely, making it durable and lightweight for carrying around.

One of the most remarkable features of the Boxclever Press Budget Planner is its comprehensive financial tracker. It provides enough room for writing down every financial detail, from income and expenses to savings and debts. The sections are divided clearly with dedicated pages for debts, savings, monthly budget, daily expenditure, annual summary, and a separate section for Christmas spending.

The planner also includes a section that helps to focus on short-term as well as long-term financial goals and create a plan for achieving them. This is a unique feature that makes this budget notebook stand out and is especially useful for beginners who are still learning about budgeting.

In terms of usability, the planner has easy-to-read font sizes and colors. It uses a monthly layout, allowing you to have a concise view of your financial status monthly, which is straightforward to track and manage.

The Boxclever Press Budget Planner also comes with pockets for keeping receipts and bills, as well as stickers for further customization.

One potential downside to this budget notebook is that it might not be ideal for individuals who want a digital integration with their budget tracking. But if you are more of a pen and paper type of person, this feature-packed, easy-to-use, and affordable budget notebook is perfect for starting your financial journey.

In conclusion, the Boxclever Press Budget Planner is a fantastic tool for beginners who are looking to keep track of their finances in a straightforward and uncomplicated way. It is budget-friendly, comprehensive, and can keep you organized in your budgeting process. So, if you are starting your journey towards financial control, this planner is a solid investment.

Setting Realistic Monthly Goals with Your Budget Planner

Using your budget planner to set realistic monthly goals is crucial. Whether your goal is to pay off debt or save for a dream vacation, detailing these goals in your budget planner can keep you motivated and on track.

- Assess Your Financial Situation: Before setting your monthly goals, it’s crucial to assess your financial situation thoroughly. This includes examining your income, expenses, debts, and savings.

- Determine Your Priorities: Decide what is most crucial to you. Is it paying off debt? Saving for a house? Having more money for leisure activities? Identifying your priorities will help establish your financial goals.

- Identify Your Goals: Once you understand your financial situation and priorities, identify the specific financial goals you want to achieve. These should be SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals.

- Set a Clear Budget: Create a realistic budget based on your income and expenses. This budget should consider all your costs, including rent/mortgage, utilities, food, transportation, and entertainment. It should also allocate money towards your savings and financial goals.

- Track Your Progress: Regularly update and check your budget planner to track your progress. Observing even small progress toward your goals can provide motivation and help you stay on track.

- Adjust as Needed: If you’re falling behind on your goals or facing unexpected expenses, adjust your budget as needed. Flexibility is crucial in managing and achieving financial goals.

- Celebrate Small Victories: Celebrate when you achieve a financial goal, no matter how small. This can keep you motivated and working towards your other financial goals.

Remember, everyone’s financial situation is different. What works for one person may not work for another. Be flexible and realistic with your goals, and most importantly, stay patient and persistent. With time and good planning, you’ll be on your way to achieving your financial goals.

Understanding Monthly Income and Spending

At its core, budget planning revolves around understanding your monthly income and spending. Using a monthly budget planner aids in breaking down these financial elements, helping you develop a more precise understanding and granting more significant control over your finances.

Monthly income refers to the total amount of money one makes in a month after taxes and other deductions. This includes cash from primary work, side gigs, retirement funds, dividends, and rental income. Knowing the exact monthly payment is crucial in budget planning. It serves as the basis for determining how much money can be allocated for a range of expenses and savings.

Alternatively, monthly spending or expense refers to all monthly money spent. It includes money spent on bills, groceries, transportation, entertainment, and other necessities and leisure. Additionally crucial to keep track of the amount spent on unexpected or incidental expenses.

The difference between monthly income and spending provides a clear picture of one’s financial status. If the income exceeds the expenses, one has a surplus and can allocate more money to savings or investments. But, if fees are more significant than the income, it denotes a deficit, which implies a need for cutting back on costs or finding extra sources of income.

A monthly budget planner is a proven tool to manage income and expenditures efficiently. It can prioritize necessary expenses, limit non-essential purchases, and generate savings. Identifying and responding appropriately to spending patterns boost financial health in the long run.

Organizing monthly income and spending is crucial to achieving financial stability. Individuals can better allocate their resources, meet their needs, and attain their financial goals through a careful and thoughtful approach to budget management.

See Related: What is The Simple Rule of 72?

Budgeting Planner Reviews

User Opinions on the Boxclever Press Budget Planner

Users commend the Boxclever Press Budget Planner for its substantial layout, tracking capabilities, and affordability. As a cheap option with high-quality features, this planner would be a valuable addition to any budgeting regimen.

Is the Clever Fox Budget Book Worth It?

Many users view the Clever Fox Budget Book as a worth-it investment. Its comprehensive features, coupled with an attractive design, make it an ideal option. It is one of the best budget planners to help track and manage your finances.

Why the Legend Budget Planner Could Be Your Best Pick

The Legend Budget Planner distinguishes itself with its monthly goal-setting pages, ensuring you stay motivated as you navigate your financial journey. Its focus on economic growth and user experience makes it potentially your best pick for a budget planner in 2023.

Getting the best budget planner on the market can be a massive step towards financial freedom and progress. Choosing a budget planner largely depends on your financial goals, preferences, spending habits, and current situation, so choosing a tool that works best for you is crucial. With the tips and highlights in this article, finding your optimal budget planner should be a walk in the park.

FAQ

What are the best budgeting planners available in notebook format?

The best-reviewed budget planner notebooks include the GoGirl Budget Planner, Clever Fox Budget Planner, and Erin Condren’s Budget Book. Each of these planners includes detailed budget tracking and a few budget categories to help you better understand where your money is going.

How can I find a cheap and effective budget planner book?

Many budget planner books are affordable and effective. The most crucial feature to look for is comprehensive budget tracking, which should break down your weekly budget into different categories. The Simplified Monthly Budget Planner is an excellent example of a budget planning book that offers effective budget planning at a budget-friendly price.

Are online budgeting planners, such as the Budget Binder, reliable compared to the notebook method?

Online budget planners can be reliable and offer features that traditional notebook planners may not, like automatic calculations and syncing across devices. But, many people prefer a physical budget planner such as a budget planner book or notebook because it offers a tactile experience that some find helpful for better understanding and controlling their budget.

How to choose a suitable budget planner book for my needs?

When looking for a budget planner, consider your personal finance goals, lifestyle, and budgeting method. For instance, if you are a frequent traveler, you might prefer a portable planner. Moreover, some planners are more detailed with budget categories, which would be beneficial if you’re looking to break down your expenses thoroughly.

What are the top features to look for in a budgeting planner that works for my monthly budget?

Key features to consider in a monthly budget planner are usability, comprehensive budget tracking, detailed breakdown into budget categories, and additional features such as goal tracking or bill organizing. As an illustration, the Clever Fox Budget Planner includes all these features and is considered a best-reviewed budget planner book.

Can the Erin Condren budget planner work as a weekly budget guide?

The Erin Condren budget planner is designed to help manage your weekly and monthly budgets. The planner incorporates detailed sections to record income, savings, and expenses, including weekly and monthly planning areas.

How will the GoGirl Budget Planner help me to control where my money is going?

The GoGirl Budget Planner simplifies tracking your weekly and monthly spending by offering organized sections for different budget categories. This lets you carefully track where every dollar is going, encouraging more mindful spending habits.

Do all budget planner books allow me to master financial planning?

Not all budget planner books are created equal; the most suitable ones will vary according to your financial goals. Planners like the Apples Budget Planner and the Simplified Budget Planner provide sections for financial goal setting and debt tracking, allowing you to master your financial planning more effectively.

What makes the Clever Fox Budget Planner a great budget planner?

The Clever Fox Budget Planner is famous for its comprehensive features. It’s not just a notebook but a complete financial planner with sections for goal setting, budget tracking, debt tracking, savings tracking, and monthly budget review. This makes it an excellent tool for anyone seeking control over their finances.

How can a budget planner book help me to pick the best budget for my needs?

A budget planner book provides a structured and detailed view of your income, savings, expenses, and debts, which allows you to understand your financial situation better. This can help you determine the best budget for your needs and financial goals.

Related Resources